SixSense Secures $8.5M Series A to Modernize Semiconductor Quality Control

A Singapore based deep tech startup called SixSense, co founded by two female engineers, just raised $8.5 million in Series A funding. That brings its total haul to about $12 million. The round was led by Peak XV’s Surge (formerly Sequoia India & Southeast Asia), alongside Alpha Intelligence Capital, FEBE, and others.

Founders With Domain Expertise

SixSense was started in 2018 by Akanksha Jagwani (CTO) and Avni Agarwal (CEO), both engineers steeped in industrial and data systems. Jagwani previously led automation projects at Hyundai Motors, GE, and startups like Embibe. Agarwal built scalable analytics systems at Visa and is drawn to deploying AI beyond fintech.

They tested multiple verticals from aviation to automotive before zeroing in on semiconductor manufacturing. What struck them was that despite troves of real time data from fabs, inspection and quality checks were still largely manual and fragmented.

What the Platform Actually Does

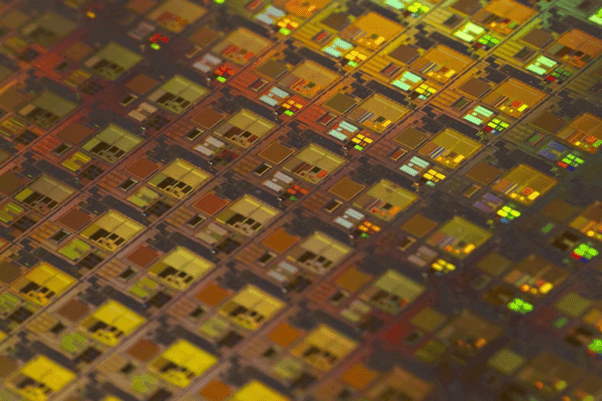

SixSense offers an AI driven platform that processes raw production data such as defect images and equipment signals and turns it into real time alerts. That helps factories catch defects early, boost yields, and reduce manual inspection work.

It is designed for use by process engineers, not data scientists. Engineers can fine tune models with their own fab data, deploy in under two days, and avoid writing any code. That makes adoption faster and more practical.

Real World Traction and Impact

SixSense is already active at major semiconductor manufacturers including GlobalFoundries and JCET. The platform has processed over 100 million chips so far. Customers are reporting production cycle speeds that are up to 30 percent faster, yield increases in the 1 to 2 percent range, and a 90 percent reduction in manual inspection work.

Their system integrates with inspection gear that covers over 60 percent of the global market, a strength in a space where legacy equipment and in house engineering tools like Cognex and Halcon still dominate.

Playing in a Growing Market

SixSense targets large chipmakers such as foundries, OSATs (outsourced semiconductor assembly and test providers), and IDMs (integrated device manufacturers). They are already working with fabs in Singapore, Malaysia, Taiwan, and Israel, and are now moving into the United States.

Geopolitical shifts, especially United States and China tensions, are pushing semiconductor investments beyond legacy hubs into places like Vietnam, India, and Malaysia. As new fabs emerge, they are often free of old systems and more open to AI native tools like the one SixSense has built.

Among Peers and Competitors

SixSense enters a field that includes large inspection equipment providers embedding AI in their tools, in house engineering efforts by chip fabs, and other startups such as Landing.ai and Robovision.

What stands out is its focus on real time pattern detection, root cause analysis, failure prediction, and fast, code free deployment for process engineers.

Why It Matters

The company is proof that AI can bring real change to sectors beyond finance and software. By unlocking the potential of vast strands of production data, SixSense helps semiconductor plants run smarter, faster, and more efficiently.

The $8.5 million raise is not just capital, it is validation. With momentum across Asia and plans to push into the United States, SixSense looks poised to help modernize semiconductor manufacturing.

SixSense is at the intersection of two critical trends: the rise of AI in hardware level operations and the push for gender diversity in leadership. And with process engineers, not programmers, as users, they have built a tool that is practical, powerful, and grounded in industrial realities.

Business News

The Connection Between Mental Well-Being and How We Live

Holistic Living: Caring for Your Mind, Body, and Surroundings

Mental Clarity: The Real Starting Point for a Balanced Life

Wendy's Just Reversed Course From New Approach With 'Project Fresh,' Following A Hefty Sales Hit.

How to Transform the Workplace into a Safe Space