Fiserv Aims for Greater Control in Merchant Transactions

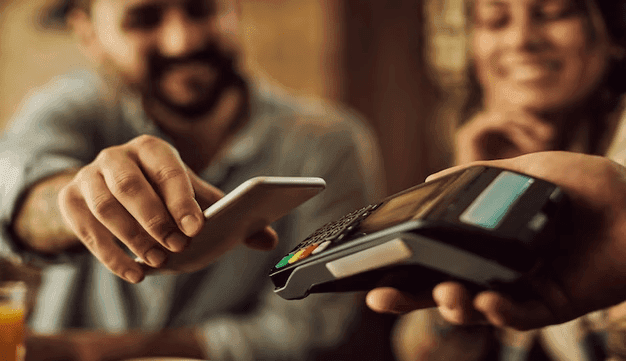

In the past, Fiserv used a bank partner to handle transactions for merchants at the end of the day. Now, they want a special license that lets them control the whole process themselves. This makes things more efficient and profitable for Fiserv because they don't have to pay a bank to do it.

The CEO of Fiserv, Frank Bisignano, is likely wanting to have more control over the whole process. They acquired First Data in 2019, which used to work with Bank of America, but that partnership ended.

It's hard for Fiserv to find banks willing to partner with them because it doesn't benefit the banks much. Handling these transactions isn't a core business for banks, and it doesn't make them much money.

In the business of handling transactions for merchants, the profit margins are very small. Without a large scale, it's tough to compete. Fiserv was the biggest non-bank company doing this in 2022, but they want even more control over the process.

However, Fiserv is clear that they don't plan to become a full-fledged bank. They'll still work with banks that want to be part of the process.

They are applying for a special license that no one else has. This license allows them to avoid some processes and have direct access to card networks. The Georgia Department of Banking and Finance hasn't accepted or rejected Fiserv's application yet.

Business News

Netflix Advertising Business Turns into a Growth Path, Revenue Surge

EFCC Calls for Suspension and Prosecution of Banks and Fintechs Linked to Fraud

How to Boost Employee Productivity in Industrial Work Environments

How Executive Culture Can Enable Abuse and Legal Exposure

Why Most Executive Books Are Written with a Ghostwriter